Owning a car in the USA comes with freedom and convenience—but also legal responsibilities. One of the most important is having the right car insurance. Whether you drive a compact sedan, a family SUV, or a luxury sports car, the right auto insurance USA policy can save you from financial stress in case of accidents, theft, or damage.

This guide will help you understand full coverage auto insurance USA, how to get cheap car insurance quotes online, and the best ways to find affordable car insurance for young drivers.

Why Car Insurance is Essential in the USA

Car accidents can happen anytime, anywhere. Without comprehensive car insurance coverage, you may face:

- High repair costs

- Expensive medical bills

- Legal liabilities

A good auto insurance USA policy provides:

- Bodily injury liability – Covers injuries you cause to others

- Property damage liability – Covers damage to other people’s property

- Collision coverage – Repairs your car after an accident

- Comprehensive coverage – Covers theft, fire, vandalism, and natural disasters

- Uninsured/Underinsured motorist coverage – Protects you if the other driver has insufficient insurance

Understanding U.S. Car Insurance Laws

Each U.S. state has different minimum coverage requirements. Almost all require liability insurance, but coverage limits vary.

| State | Minimum Liability Coverage | Notes |

|---|---|---|

| California | $15,000 / $30,000 / $5,000 | Minimum legal requirement |

| Texas | $30,000 / $60,000 / $25,000 | Higher limits for better protection |

| Florida | $10,000 PIP / $10,000 property damage | No bodily injury liability required |

| New York | $25,000 / $50,000 / $10,000 | Includes uninsured motorist coverage |

| Illinois | $25,000 / $50,000 / $20,000 | Follows state minimums |

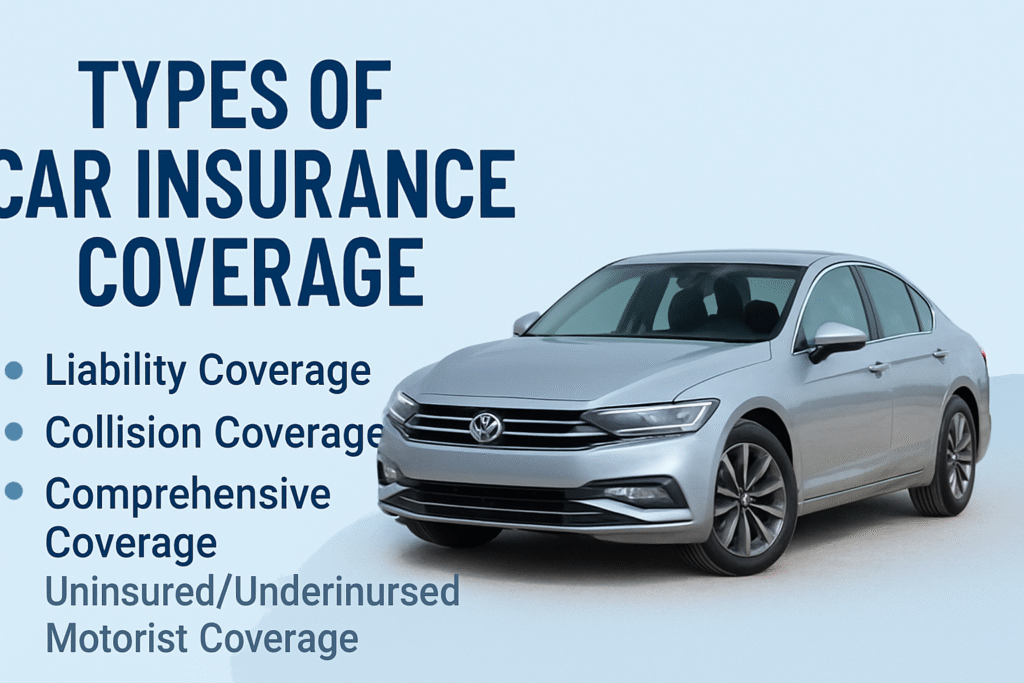

Types of Car Insurance Coverage

When comparing auto insurance USA policies, you’ll find these main options:

Liability Insurance

Mandatory in most states; covers damages and injuries to others when you’re at fault.

Collision Coverage

Pays for your car repairs after an accident, regardless of fault.

Comprehensive Coverage

Protects against theft, vandalism, fire, and natural disasters.

Personal Injury Protection (PIP)

Covers medical expenses and lost wages after an accident.

Medical Payments Coverage

Helps pay for your medical bills regardless of fault.

Gap Insurance

Covers the difference between your car’s loan balance and its market value if totaled.

How Much Does Car Insurance Cost in the USA?

The cost depends on:

- State & ZIP code

- Age and driving record

- Vehicle make and model

- Coverage limits

On average:

- Minimum liability coverage – $500–$1,000/year

- Full coverage auto insurance – $1,200–$2,500/year

Tips for Getting Cheap Car Insurance Quotes Online

- Compare multiple providers using an auto insurance comparison USA tool

- Bundle home and car insurance policies for discounts

- Choose a higher deductible for lower monthly premiums

- Maintain a clean driving record

- Take defensive driving courses for extra savings

Best Car Insurance Companies in the USA

| Company | Best For | Notable Feature |

|---|---|---|

| GEICO | Low-cost coverage | Easy online policy management |

| Progressive | Customizable plans | Accident forgiveness |

| State Farm | Nationwide service | Local agents available |

| Allstate | Comprehensive options | New car replacement coverage |

| USAA | Military members & families | Exceptional claims service |

Common Mistakes to Avoid

- Only buying the state minimum coverage

- Not adding uninsured motorist coverage

- Forgetting to update policies after moving states

- Ignoring discounts for safe driving

Filing a Car Insurance Claim

- Contact your insurer immediately after an accident

- Document the damage with photos

- Get repair estimates

- Follow up until the claim is resolved

FAQs

Is car insurance mandatory in all states?

Yes, except in New Hampshire, where proof of financial responsibility is required instead.

Can I get affordable car insurance for young drivers?

Yes, by using student discounts, being added to a family policy, and maintaining good grades.

Does full coverage include roadside assistance?

Only if you add it to your policy.

Conclusion

Whether you’re looking for cheap auto insurance USA, full coverage auto insurance, or affordable car insurance for young drivers, the key is to compare policies, know your state’s laws, and choose the right coverage level.

By being informed, you can secure the best car insurance rates USA while keeping yourself financially protected.